Affordable housing: Is it in the budget?

Everyone knows housing costs are out of control. We feel it every month when the rent or mortgage payment is due. In Culver City, half of renters spend more than 30% of their income on rent. One in four renters spend more than 50% of their income on rent.

Individual cities can’t solve housing unaffordability on their own, but there is a lot that a city can do to make a difference. For example, Culver City’s rent control program protects tenants more than most. But rent control only stops rent from increasing more than inflation. It can slow down rent increases, but it doesn’t do enough in a city like ours where housing is already so unaffordable.

Culver City can fund new affordable housing

Cities that are serious about addressing housing affordability help fund the construction of new housing units that are required by law to be leased at an affordable rent. Tenants who live in these units would never have to pay more than 30% of their monthly income on rent.

But right now, Culver City simply doesn’t have enough of this kind of affordable housing. The vast majority of new development in the city will be market-rate, which means it’s out of reach for working families, seniors on fixed incomes, and young people trying to stay in the community where they grew up.

One reason for this shortfall is how the city has chosen to allocate its limited development funds. In the past, money that could have gone toward building affordable housing was instead used to subsidize private commercial projects — developments that don’t include housing at all, let alone housing for those most in need.

Protecting affordable housing money with a trust fund

That’s why the City Council’s proposal to create a dedicated affordable housing trust fund is so important. A housing trust fund would give Culver City a stable, protected source of funding specifically for building affordable housing. It would also ensure that future city dollars go directly toward projects that meet the community’s most urgent needs.

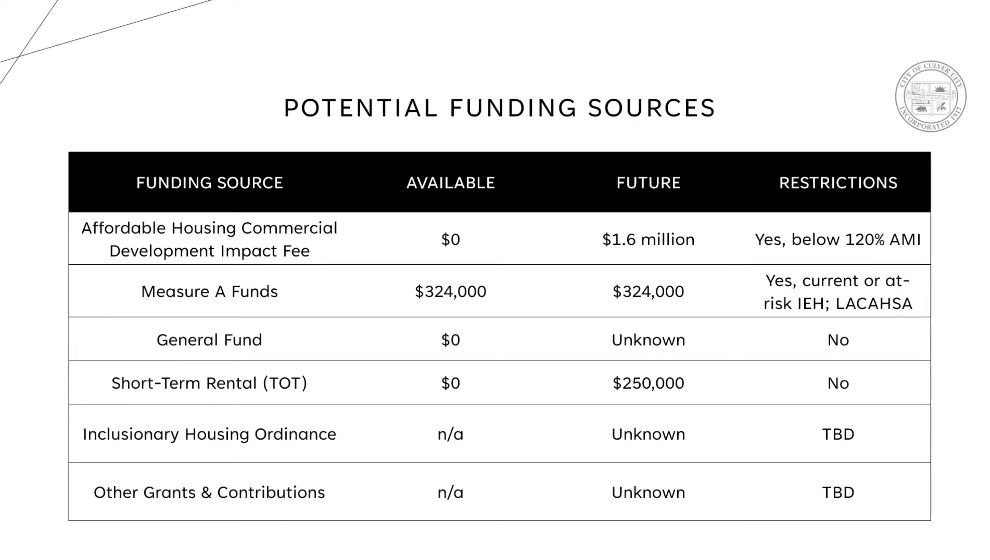

The city’s April 28 presentation identified potential sources of funding for the affordable housing trust fund.

If a housing trust fund had already been in place, it could have helped finance developments like Jubilo Village — a proposed development that will provide 93 affordable homes. The project nearly fell apart because the city lacks a dedicated fund for affordable housing.

In the proposed 2025-2026 budget, the city was barely able to pull together $4 million for Jubilo Village without dipping into its contingency reserves. These essential funds will allow Jubilo Village to break ground later this year, but we won’t be so lucky when the next affordable housing project comes along.

We can’t afford to miss opportunities like Jubilo Village. Creating the affordable housing trust fund is a critical first step. The next is making sure it has the resources to actually build housing. That means pursuing new sources of funding — whether it’s through grants, partnerships, or developer fees — so that Culver City can finally start delivering the affordable homes its residents deserve.